Everyone’s situation with finances varies by a multitude of shades. The amount of money you were surrounded by growing up, how your parents handled it, and all that you have seen – completely shapes your financial approach. Then there’s the income portion we all manage to obtain as we get older. Sometimes the money a person earns is not enough to get the bare necessities. Others earn more than twice the amount needed to live as they choose. Each situation and outlook will require a unique approach. There’s no one size fits all to exactly what to do. There are basic principles and then there‘s the ways we adopt that to our financial strategy.

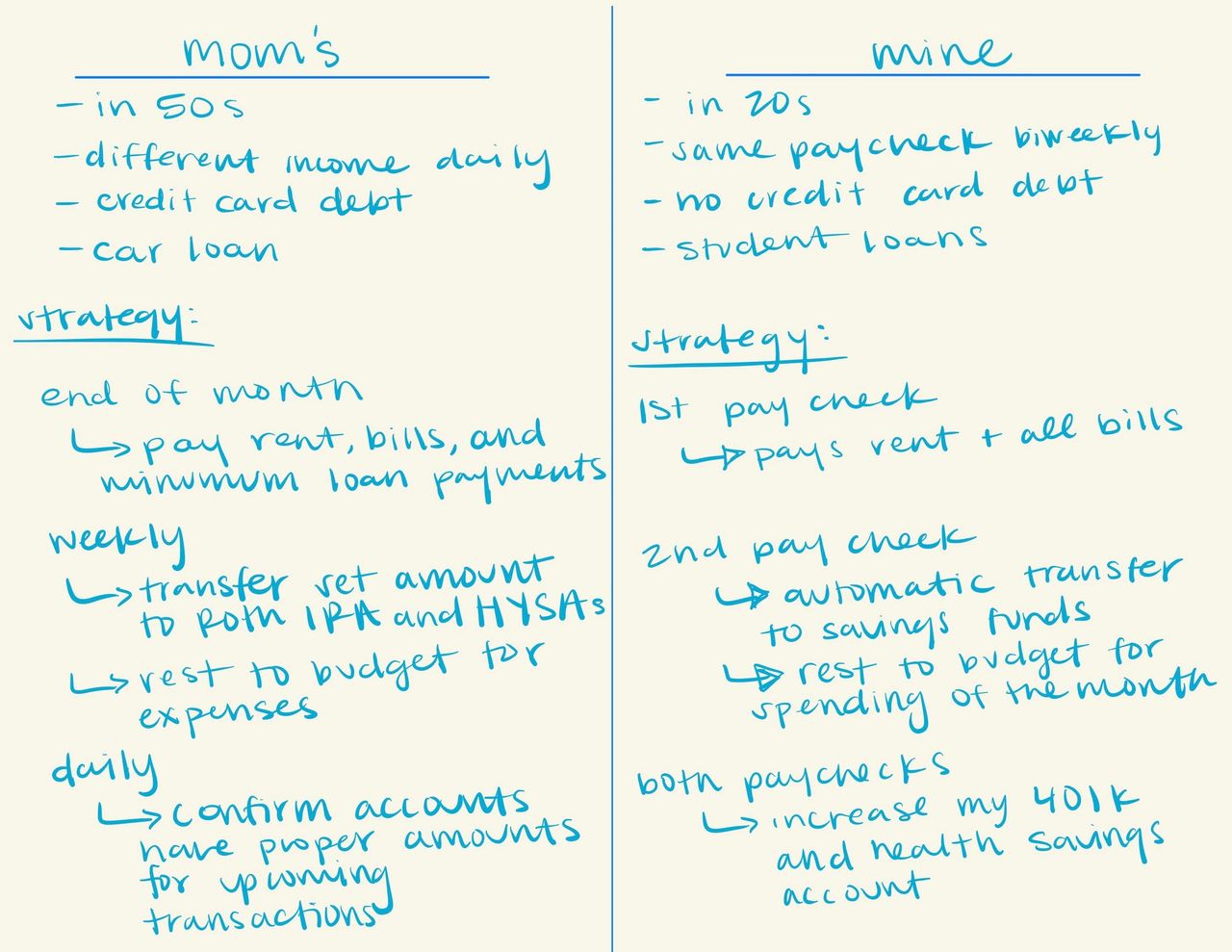

For example, the adjustments my mom’s financial strategy has are drastically different than what mine are. Why? Because of our age, income, and money habits. Going off the 5 rules of my moolah mindset, I’m going to break down a few ways to try to approach implementing them for different financial situations. I’ll be building off my mom’s approach versus mine & a few other ideas in between. The rules will all intermix and relate to each other within financial planning.

Starting off with #1 though – Credit Card Debt. The person that has the ability to pay off their credit card bill every month will look at this rule and find a simpler way to succeed at it than the individual that finds themselves paying +20% interest on payments for both splurges and necessities. In the first scenario, the card can be paid off however often the person sees fit. If they are ones that easily keep themselves from going beyond their means they could pay it off once a month. Those that might get a bit relaxed seeing the checking account cushioned might do better paying it off weekly or biweekly to actually track their financial pulse. However, if you find that you are constantly decreasing your available credit, whether its due to splurging too much or because groceries are needed, then it might be more beneficial to

1.a: Determine which of those situations you fall into when increasing your debt

1.b: Understand your financial input on a basis that suits you

1.c: Schedule the actions of your plan at appropriate intervals

Rule #2 – Building Emergency Savings (ESF) still applies. The individual that increases debt to pay off bills will need some ESF in place to protect themselves from having to use the card. Otherwise, an emergency happens (tire pops, dog is sick, an unexpected bill hits, etc.) and next thing they know the card has to be pulled out to eat. Now the amount of the ESF does not need to be 3-6 months at this stage or even quickly (getting even a couple hundred or 1 – 2k makes all the difference here). As for the happy spender, they will also need an ESF, but it might help them more to freeze their cards in a ziplock bag or cut them to stop reaching for them. Someone living beyond their means might find it beneficial to find a barrier that stops the ease of using their card. Then they can build their ESF at a realistic interval based on their income schedule.

With these scenarios here is where we start getting to a combination of 1.b and 1.c mentioned above. A person that gets paid monthly v.s. biweekly v.s. daily will have completely different amounts in their accounts at one time. For simplicity sake let’s say the monthly income is $300 dollars and the goal is to save $10 a month. The one getting paid $300 on the 30th could set aside $10 on the first and leave $290 to budget the rest of the month. The one getting paid $150 every two weeks could try $5 after the first paycheck and $5 after the second. However, the person that earns $10 a day, or even $8 one day (then $4 the next then $12 etc. that will average to $300 throughout the month) might struggle with trying to do $5 or $10 after any one day. But what if they decide to put aside $2.5 a week (could even break it down by one day 20¢, another 75¢ etc) then at the end of a calendar month they also still have $10. Everyone reaches the same output but they changed their saving interval schedule based on their financial input.

No amount of saving is truly too small. It’s better to start with saving $10, $20, or $100 to not only get one step closer to an emergency fund that can help, but also to start building this financial habit. Automating the amount saved or having it transfer to an account that is harder to reach can help increase the odds the funds are saved and left alone for a real rainy day. Now where’s good place to put those funds? Rule #3 – High Yield Savings Account (HYSA). The bank gives a greater amount of money for keeping funds in a HYSA. Similar to a normal savings account, HYSAs can have transaction limits or even monthly fees. When choosing one I kept in mind the ease of access to the funds, whether the bank was only online, and the fees vs the interest rate. NerdWallet helped compare the account options. Personally, I have multiple HYSAs. One holds my ESF and the others have funds I am building up for different goals (trips, gifts, a car, house, etc.). I like to keep them all separate for accountability and visibility.

All of my personal finance rules go hand and hand. All intertwining and affecting one another, including the last two:

#4 – Budget by preparing for the future while living in the now

#5 – Compare rates between debts and investments

I’ve notice some people either prepare too much for the future or none at all. Some spend their days living for the present without much thought for where they are going. I like to try to live in a balance. The truth is none of us know if we will make it to the future we are planning for so it’s important to take moments to decide the future is now. However, if we do make it to say 60, 70, or 85, we probably don’t want to arrive knowing there is no way we can afford a comfortable way of life. This is where budgeting can help. It helps in seeing where money is going and allowing us to correct the course. Some might need to track more stringently than others. Financial books state the more accurately you do it the better, but I know that for some of us checking every dollar in and out will either take a long time to get used to or will just never be the case.

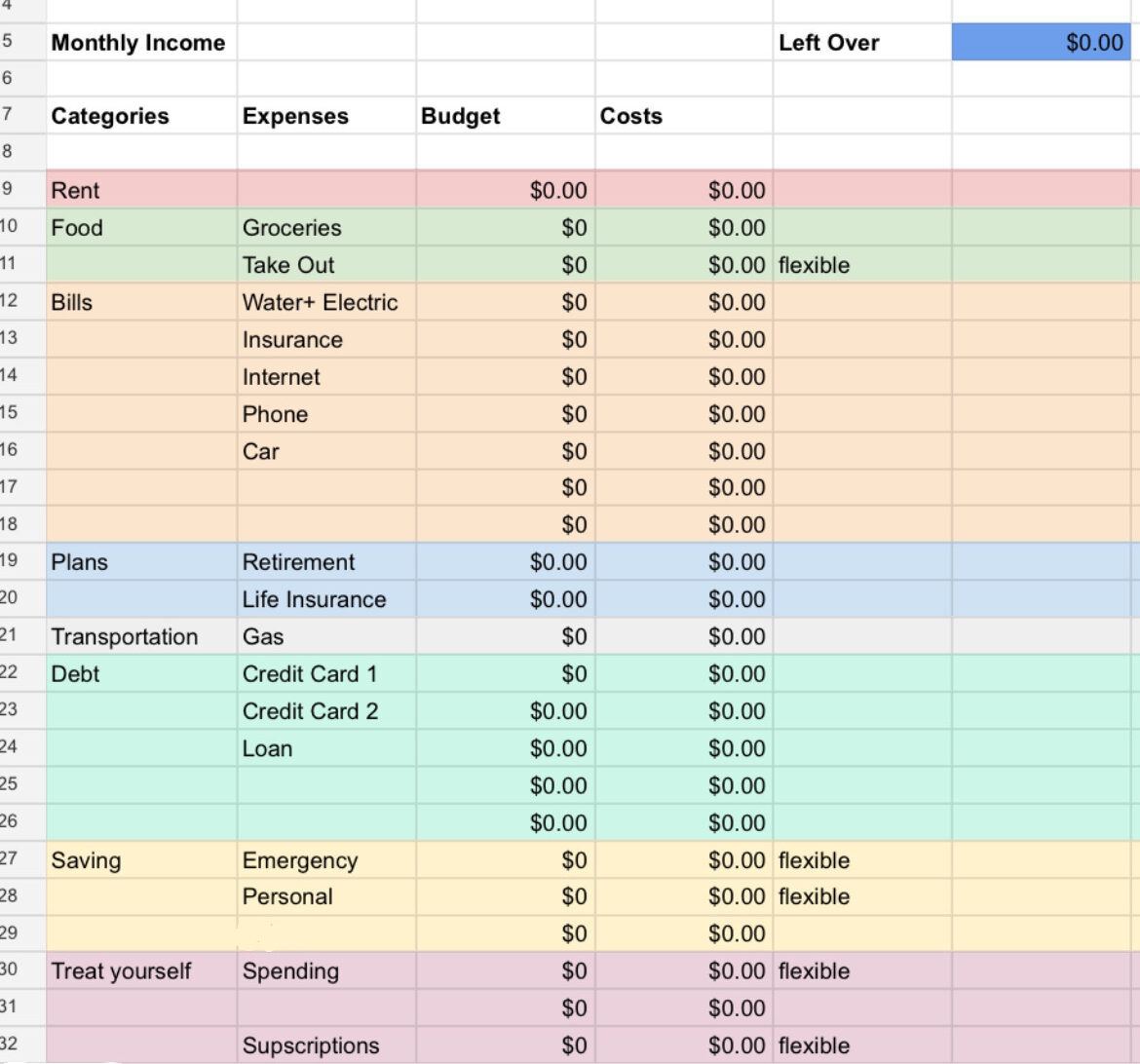

I tend to track averages. First I found relative amounts for the categories where my money is going (food, transportation, splurges, bills etc). Then I determined the set amount from my income that I wanted my future self to be able to use. I checked whether any flexible categories (take out, shopping, subscriptions) should be reduced. Then I kept this in mind as I scheduled my money to go into different savings funds within set intervals. For example, I knew to be more aware of not adding subscriptions or to cancel some of them because I was planning to saving more a month. Knowing the average amounts of where our money is going allows us to ensure we save (or even invest) at an appropriate amount while also allocating some cash to go to restaurants or buy a new pair of shoes.

Okay now we‘ve determined the intervals and rate at which we will save for our ESFs within a HYSA. We know how much we can relatively spend in different categories, how much is being put away for our future, and how much we need to repay for debts. But how to decide which debts to focus on? Should anything be invested as well? Time is our best friend with investing, but also biggest risk with debt. My rule of thumb when deciding how to use it is to check the interest rates. Since credit cards have the highest rates, anything on a credit card will always get any additional income I have first. Then I’ll check loans and apply any extra cash on hand for the ones with the highest interest rate. If my debts have an interest rate of 6% or less, then I pay the minimum bill amount for the debt and go invest the rest. Like I said before: I believe throughout the course of my repayment I will have earned more money investing than I would lose by not paying the debt.

Moolah strategies revolve around the same principles but require different approaches based on the state of our life. Learning to adjust it through out changes is key to reaching our goals. Below is an example breakdown of my mom’s vs my financial strategy at one point. Theres also a blank budget showing the generic categories our money goes into. I regularly see how we are doing every quarter and make any tweaks as needed.

**Not financial advice.**

**Please always do your own research.**

Leave a Reply